Official letter from the Ministry of non-receipt of the impact of the debt crisis, suspension of compensation and "uncertainty of the 3 projects

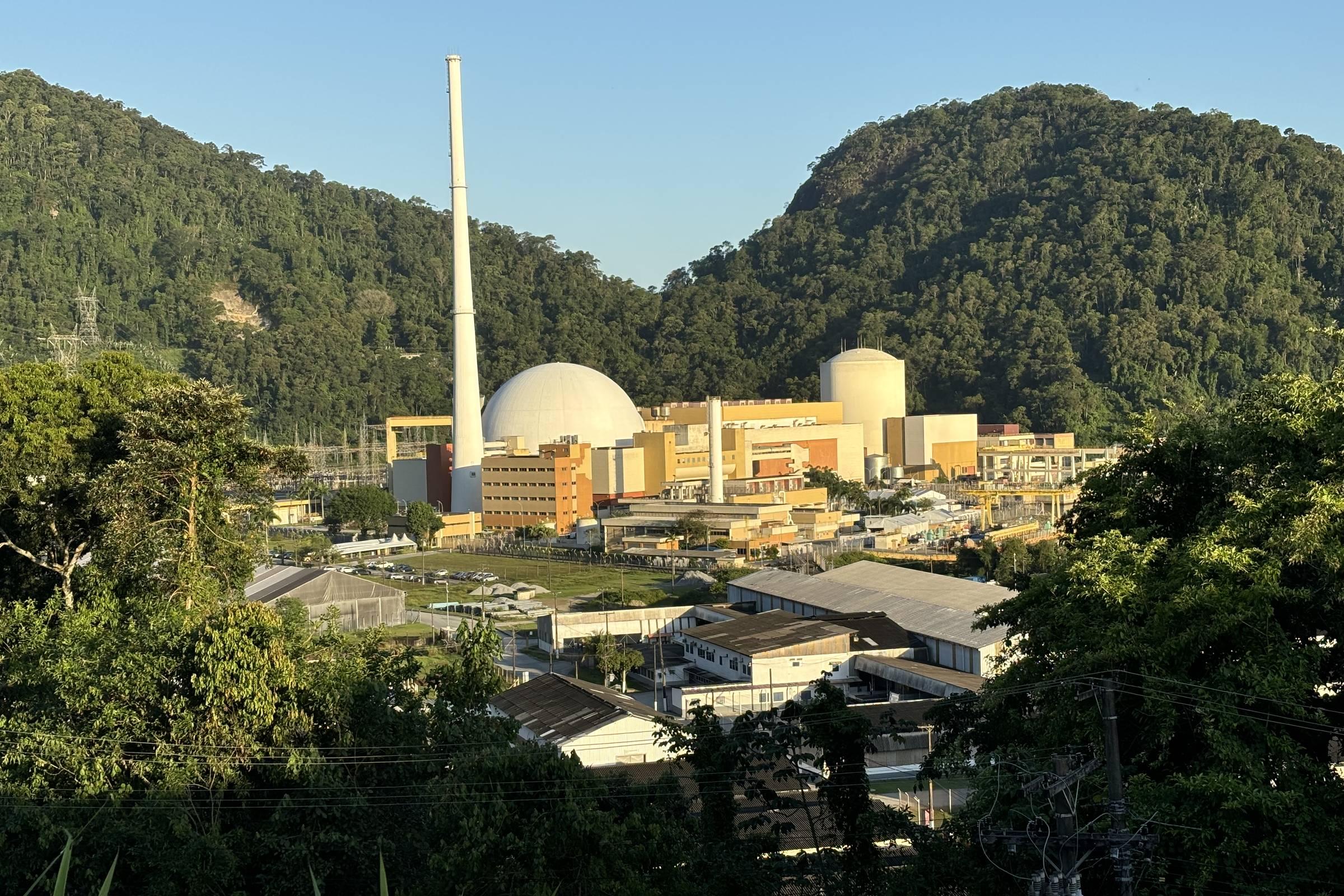

Plants 1 and 2 are the electronuclear responsible for Angra, and R $ 1.4 billion to make payments until the end of 2025.

In a letter sent last Monday (20) to Enbpar, a public company through the union to control the plants, the eletronuclear order warned that any failure of the contract would have far-reaching effects, with an expectation of around R $ 6.5 billion in debt, the retention of income given as a guarantee for financing and "prevention of the definition.

"Thus, there is a risk of operational and financial collapse of Eetronuclear from November 2025, due to the exhaustion of cash, with possible consequences," says the document obtained by Fulha.

The warning is the latest in a series of bailout requests made by the state-owned company over the past few months.It is at a time when the private share of the company (67.95% of the total shares) will be transferred from its owner.Âmbar Energia, a subsidiary of J&F, owned by brothers Joesley and Wesley Batista, signed an agreement to buy a stake in Eletrobras, now called Axia Energia, for R$535 million.

While the deal is still pending, both companies are trying to hold positions at every hole in Electronics' Cash.

The rhetoric from Axia is that the sensitive position of the state-owned company was discussed in the negotiations, and its obligations, which have now been transferred to J&F, are limited to the Angra 3 work. J&F's view is that the group is not yet the official owner of Eletronuclear's shares, and although it intends to invest capital in the future, it cannot cause an immediate imbalance.

Axia and J&F did not comment when contacted through their advisers.

The danger is that this disaster bill will eventually fall into the union's lap.The state-owned company has already warned that without a solution to the imminent collapse, it could depend on the National Treasury for workers and operating costs.

Such an outcome would be disastrous for the government, which would have to make room in the fiscal budget to cover electronuclear costs through cuts in other policies.Folha revealed that the financial group faced a similar dilemma with Corrios, which will now receive a state-guaranteed loan of R$20 billion.

An earlier document, sent by ENBPar to MME (Ministry of Mines and Energy) on September 18, describes Eletronuclear's predicament.

In December 2025, the company must pay a debt of R$ 570 million with the banks BTG puctual and abc brasil, which is the contract allowing the extension of the operating license of Angra 1.

The company had hoped to pay the bill with a 2.4 billion reais bond issue underwritten by the former Eletrobras, which will now be taken over by J&F, but the operation has yet to take off.Eletronuclear plans to complete the process by December.

“Without the influx of resources from the issue, the company will default, exposing itself not only to fines and interest, but also to the acceleration of other debts,” ENBPar warned, citing the financing contracted with the BNDES (National Bank for Economic and Social Development) and the Caixa Económica Federal.When contacted, Caixa, BTG and ABC Brasil said they would not comment on the matter.BNDES has not responded.

The letter also mentions the role of R $ 450 million with Inb (Indútsstrias Nuclelares made bratural in October to something close to R $ 700 million already.

The company invests about $ 1 billion a year in the work and debt service for Warra 3, an incomplete project that brings money to the state-owned company.The right to use the money of the company, as it does not cover the tariff.

In the document, ENBPar tells the union how much money to invest in the company and assumes that investment is a prerequisite for issuing bonds.

"No âmbito da emissão em análise, cujo uso dos recursos será direcionado ao LTO [programa extensão de vida útil] de Angra 1, os estudos apontam a necessidade adicional de aporte mínimo do controlador [União], estimado em R$ 1,4 bilhão, a fim de mitigar o risco de perda de controle da Eletronuclear. Essa exigência decorre do Termo de Conciliação e das condições de capitalização previstas para a operação", afirmou a empresa.

When contacted, the Ministry of Finance said that it is "restricted in the request for funds in public projects".He also said that the ministry should promote better management and business practices.

"Any request to repeat must be based on a comprehensive sustainability plan, a concrete assessment that must be carried out first at the sector level and with the coordination of state companies," he said.

Without the prospect of investment, elettonkarlearlear is looking for other options, such as the company "irregular and compliance with the company" among the regulations of Government No. 1200 of 2025, which regulate the financial renewal funds that are not dependent on companies that are not dependent.

In this way, the company can receive funds from the Union without becoming dependent, but it has two years to implement the adjustment plan.The measure is subject to the approval of MME and MGI (Ministry of Management and Innovation).When contacted, they did not speak.

Nuclear Power is also seeking to borrow $1.2 billion from a fund created to finance the safe decommissioning of nuclear plants.This claim corresponds to one-third of the amount available in the fund.And based on the analysis of ANIL (National Electrical Energy Agency) and ANSN (National Nuclear Security Agency), there is a risk of releasing only part of the resource.

On September 30, Minister Alexandre Silveira (Mines and Energy) warned Ministers Fernando Haddad (Finance) and Esther Dweck (Management and Innovation) that projections for investment in the company in 2026 were also removed from next year's budget proposal.According to him, the decision to close the facilities "immediately and significantly" affects the company's ability to keep the company afloat and meet operational and work obligations.

When contacting Germany, the press reported that each departure provided money, but did not solve the main equation per year for Angra 1 and 2.

Comments do not reflect the views of this newspaper;the author is responsible.